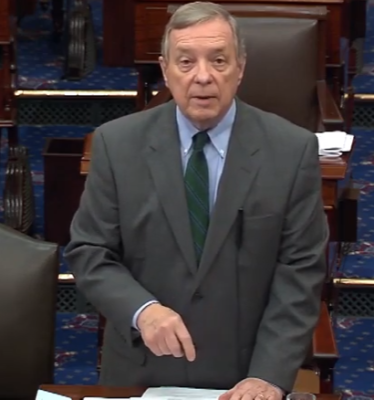

Illinois Democratic Senator Dick Durbin continued his pursuit to overturn Department of Education Secretary Betsy DeVos’ rewrite of the Student Borrower Defense rules that he says disproportionately effects Veterans and students victimized by defunct for-profit colleges. Durbin is the Senate co-sponsor of Senate Joint Resolution 56 that is expected to be voted on in the coming weeks to overturn the new rules that calls on students to present individualized cases to the Department of Education. The measure passed the House of Representatives 231-180 on Thursday last week.

Durbin says that burden of proof falls on the student now: “This new rule by Secretary DeVos would not allow borrowers to receive the federal student loan discharge currently in the law. It’s why more than 60 organizations are supporting the resolution which the House voted on last week and are supporting the companion resolution I’ve introduced in the Senate. Among those supporting our effort, the American Federation of Teachers, the National Education Association, Student Veterans of America, and the American Legion. She places burdens on these students that we’ve not seen before. Bascially Secretary DeVos is saying to these students: ‘Lawyer up!’ You just can’t make your plea to the Department of Education, that you along with others were defrauded by representations in the material that these schools distributed or the promises that they made. Not good enough under the new rule written by Secretary DeVos. What she has basically said is that each one of these students now has an individual responsibility to prove that that student was defrauded, that there was a representation to that student as opposed to being made by the school to all the students or in its publications and the like.”

According to an analysis by The Institute for College Access and Success, the DeVos borrower defense rule will cancel just three percent of all loans associated with misconduct. According to Durbin’s office, the Department of Education under DeVos has failed to process 180,000 borrower defense applications since March 31st of last year.