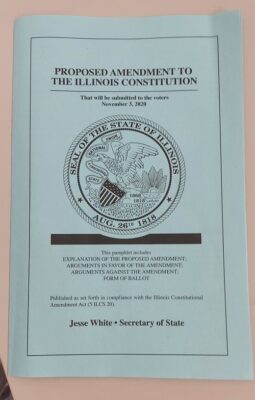

The conservative-leaning Illinois Policy Institute has filed a lawsuit in state court about the language for the fair tax amendment currently on the ballot. Illinois voters received blue pamphlets within the last week from Secretary of State Jesse White’s office explaining the proposed Constitutional amendment. The Illinois Policy Institute lawsuit filed in Cook County Court on Monday says that the explanation of the proposed amendment and the arguments in favor of the amendment contained in the pamphlet are misleading voters.

IPI alleges in the suit that the pamphlet’s violate both the Free and Equal Clause of the Illinois Constitution and the 14th Amendment of the U.S. Constitution. The one-count suit demands the Secretary of State to issue a corrective notice with suggestions outlined in the language of the lawsuit suggested by IPI.

The lawsuit also props up comments made by Illinois State Treasurer Michael Frerichs this summer about the fair tax. The Chicago Daily Herald reported in June that Frerichs told a Des Plaines Chamber of Commerce event a progressive tax would “make clear you can have graduated rates when you are taxing retirement income.” Frerichs clarified the statements in August in Springfield: “What we were talking about when we were talking about retirement income was people like a university doctor at a teaching hospital drawing about half a million dollars a year in pension, talking about a retired university official who retired at age 55 drawing $400,000 a year in pension income. There’s a retired superintendent in the suburbs who has been accused of financial irregularities drawing $350,000 a year in pensions. That’s what I was talking about. I was not pushing for that taxation. I was talking about an organization that for years has argued for reducing pension benefits, and then was taking what seemed to be the opposite, contrary opinion. The General Assembly and the governor has already set rates, and those rates do not require any taxation on retirement income.” Frerichs is allegedly referencing rates passed in a law by the General Assembly in May 2019 in tandem with the graduated income tax amendment.

According to the lawsuit outlined by Illinois NPR’s Hannah Meisel; among other arguments, the suit alleges the explanation and arguments in favor of the amendment could “induce retirees into voting to impose on themselves a tax on retirement income.”

The IPI lawsuit alleges that tax rates with the amendment would change over time, and the amendment makes no guarantee of who will be taxed or how they will be taxed. Millionaires and billionaires in the state along with several labor organization have poured millions of dollars into campaigns both for and against the amendment over the last month.

According to Illinois NPR, the suit’s language is based on a 2008 state appellate court decision upholding a trial court’s ruling requiring the Secretary of State to issue a corrective notice to voters after the Chicago Bar Association objected to the language contained in the constitutional amendment pamphlet explaining the motion put to Illinois voters every 20 years asking whether the state should convene a constitutional convention.