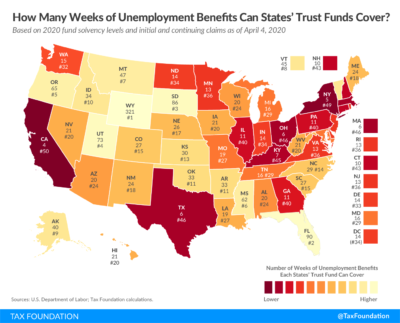

Illinois may run out of money to pay jobless benefits. A new study produced by the Tax Foundation has found the state to be one of the least prepared for an unemployment crisis. According to the study, Illinois will roughly have enough money to cover about 11 weeks worth of benefits before having to borrow money.

The study says Illinois ranks 40th in the country in terms of how many weeks a state’s trust fund can cover. The ranking is based on 2020 fund solvency levels and initial and continuing unemployment claims as of April 4th. Illinois had 141,000 initial new claims last week and 630,000 over the last 4 weeks.

Illinois may have to turn to the federal government for loans from the federal unemployment compensation trust fund as an option to cover benefits. Illinois became the first state to get a negative credit rating outlook in the wake of the coronavirus outbreak last week from S&P Global Ratings. Illinois is currently the lowest credit rated state in the union. If it drops one step further in credit rating, it would be the first state to move into junk status since the 1930s. If Illinois were to borrow from the federal government to cover costs, the state’s businesses would have to pay higher federal unemployment insurance taxes to compensate for the high interest rate due to the state’s poor credit rating.

The federal CARES Act provides an additional $600 each week to unemployed workers but has no language on how states are to meet those obligations.

According to the report, Wyoming would have the longest-lasting trust fund, with money to pay 321 weeks of benefits. California is at the bottom of the list, likely lasting only four weeks before looking for new sources of money.