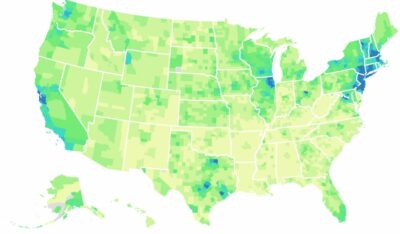

A Tax Foundation study published in August says West Central Illinois has some of the cheapest property taxes in the state. The Tax Foundation study was based on median property taxes paid within counties in 2018, based on five-year estimates. Lake County, Illinois has the highest average taxes in the state on average with $7,347 paid annually. It’s in the Top 25 highest annual property taxes in the nation behind locations in California, Connecticut, New York, and New Jersey.

Sangamon & Morgan County have the highest property taxes in West Central Illinois. Sangamon County’s average is $2,794. Adams County is next highest at $2,130. Morgan County sits at $2,041. Calhoun is fourth in the region at $1,916. Macoupin County rounds out the top 5 highest at $1,632.

Greene County has some of the cheapest property taxes in the area at $1,277. Scott County is next lowest at $1,291. Pike County is third lowest with an average of $1,382.

Property tax revenues remain a prime source of funds for state and local governments, with the Tax Foundation saying that property taxes comprised 31.9% of total state and local tax collections in the United States, more than any other source of tax revenue. In that same year, property taxes accounted for a whopping 72% of local tax collections and 26% of overall local government revenue according to stats from the U.S. Census Bureau.

The Tax Foundation says the higher bills in some places over others comes down to the “Benefit Principle” of government finance: the people paying the higher bills are most often the ones benefiting the most from the government’s services.